Divest Reinvents African Fintech with V3, Connecting Digital Assets and Traditional Finance

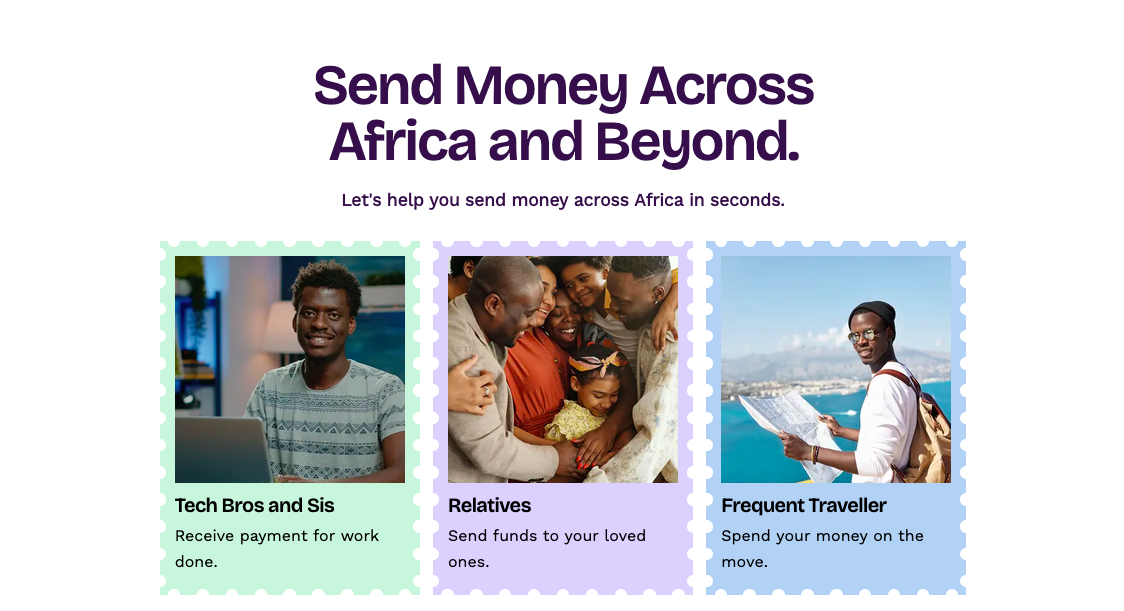

A Pan-African financial services platform, Divest has announced the launch of Divest V3, a major product update that widens its scope beyond cryptocurrency in order to provide a smarter, integrated platform for making transactions across Africa.

Divest, which started off as a company set to bridge the gap between digital assets and traditional finance, has moved forward to create a significant reputation as one of Africa’s most dependable and quick turn-off services. Hence introducing Divest V3, as the company continues to expand its reach by incorporating both traditional and digital money transfers for users to enjoy full-service on the financial service platform.

The Divest V3 is structured to provide a dual-experience providing;

- Money Exchange: Users can make smooth and safe transactions between African marketplaces.

- Crypto-to-Cash: It preserves Divest's trademark feature of instant cryptocurrency conversions, now updated into a seamless user interface.

- Also users will get to partake from a structured incentives system through the newly launched Divest Rewards program.

Divest’s growth into expansion shows its quest for Africa’s increasing need for digital financial solutions and cross-border transactions. The startup which has acquired over 150,000 users across several countries such as Nigeria, South Africa, Ghana and Kenya aims at creating ease to make seamless transactions, business payments, and remittances easier for customers as well as businesses.

CEO Kelechi Idoko acknowledged the company's dedication to financial inclusion and innovation by emphasizing that the introduction of V3 is "a pivotal step toward building a smarter way to move money across Africa."

With companies like Divest promoting the ideology to improve adoption of cryptocurrencies and traditional banking systems, Africa’s fintech industry will keep getting the global recognition it deserves. Divest V3 has the structure to primarily build the digital economy of Africa by ensuring quick, safe, and transparent transactions.